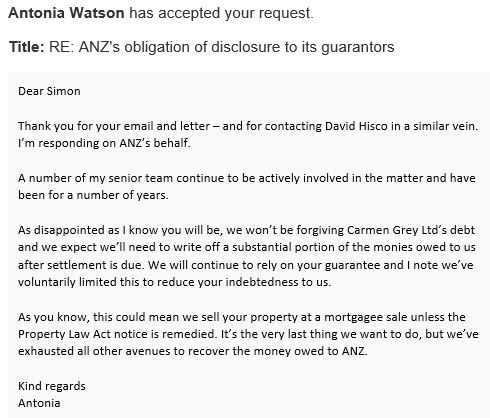

Antonia is ANZ’s Managing Director for Retail and Business Banking and a member of ANZ’s senior executive team. She responded to me when I raised my concerns with ANZ’s board a week or so ago…

If you watch this or nay of the other videos of her online, she speaks well and is clearly a smart person who will probably be leading many of the changes looming for New Zealand’s banking industry…

Since Antonia’s response, things have gotten a bit wobbly for ANZ and the other big banks in New Zealand. They are being slammed for posting grossly large annual profits, none larger than ANZ’s; and yesterday’s release of the joint FMA/RBNZ report into banking conduct in New Zealand has surprised few and angered many.

Hi Antonia

Thanks for such a swift response…

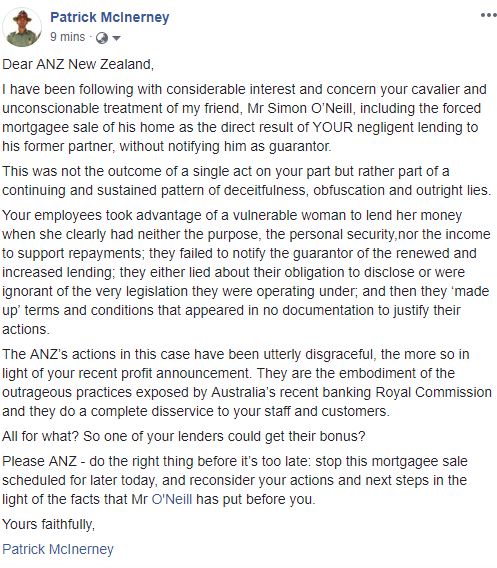

My apologies for taking so long to respond…this ‘went noisy’ once the first auction sign went up on my front fence (I was always clear that this would be the catalyst for me to bring this out into the open). In the last week or so, I have been humbled and embarrassed by the amount or moral and practical support from my family and local and professional communities…it has really stretched me just keeping up with emails, messages and phone calls of moral and practical support.

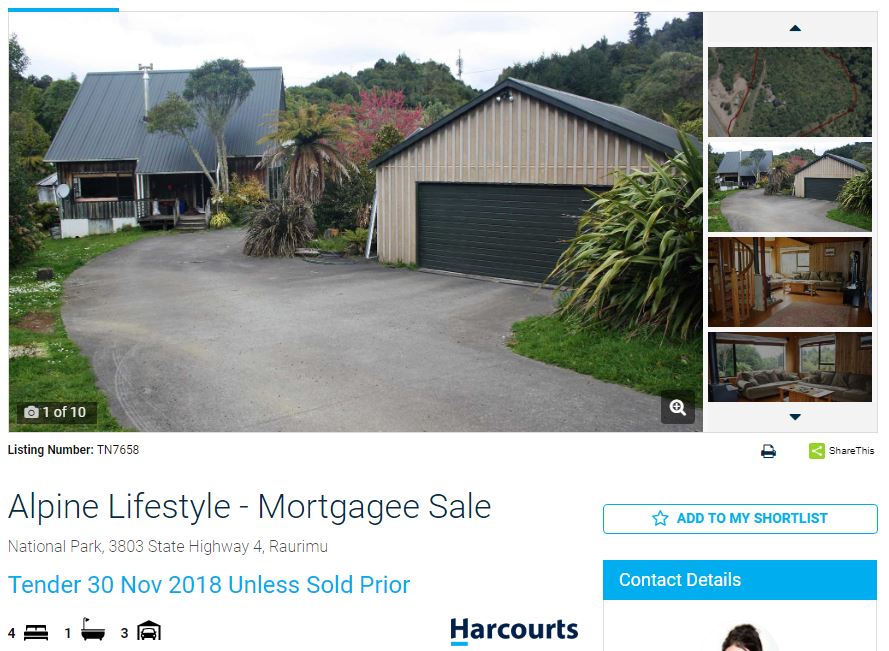

There’s no uncertainty about what may happen to my home. It is being forcibly auctioned by ANZ. In Taumarunui. On Thursday. At 11AM.

But it’s not too late…

Yesterday we saw the FMA and RBNZ release their findings from their joint inquiry into banking conduct in New Zealand. I doubt that there were many surprises there for either of us. It is quite clear that, while perhaps not on the same scale of the findings of the Australian Banking Commission, bank’s management of conduct risk in New Zealand could have been much better and ANZ is up there among those that ‘don’t get it’. I’ve tried to discuss conduct risk with some of your senior staff as part of trying to resolve our current issues, and they just didn’t get the concept…at all…

Even putting aside (for a moment) the original lending that started all this, ANZ’s conduct in my case since this all started in November 2013 (the 11th, so five years ago today week) has not been flash. It certainly has not been what we should expect from a major banking institution, although the sad truth is that it has probably been exactly what we have come to expect from the major banks.

ANZ officers have said that the Credit Contracts and Consumer Finance Act prevented them disclosing information on the company to me. As I am sure you – and they – knew, this Act, by definition, only covers personal lending. It does not even mention company lending, let alone discuss any rules for or against disclosure by banks to guarantors of company lending. Surely we should be able to credit bank officers in management positions with adequate knowledge of the legislation that does or does not apply to different lending environments? Once might be a honest mistake but when the same ‘mistake’ happens at different levels in different locations in the same bank…well… “Mr Bond, they have a saying: Once is happenstance. Twice is coincidence. The third time it’s enemy action.”

Even today, your staff insist that they had no authority to disclose any information on the company to me. I had no access to the company’s documentation for two and a half years, until mid-2106. When I gain that access I found that the loan documents contained a clause specifically authorising ANZ to release information on the company’s financial position to guarantors. Does ANZ really want us to believe that its staff aren’t aware of the contents of its own loan documents? Really…? Once again, Mr Bond…

Was ANZ also unaware of the Privacy Commissioner’s determination in 2012 that a guarantor’s interests and rights in jointly owned property used as security bring that information within the scope of ‘personal information’. This means that this information should be releasable under the Privacy Act. ANZ staff – your staff – should have known this.

The Code of Banking Conduct is clear that member banks, like ANZ, have an obligation to disclose information about lending to any party providing security for that lending. The guarantee and loan documents are equally clear that, for ANZ, guarantees are types of security. Instead of accepting and honouring this, ANZ invented a definition of the term ‘security provider’ that it attributed to the Code to support its position that the Code’s disclosure obligations for guarantees and security are different. The truth is that the term ‘security provider’ does not appear in the 2002, 2007 or 2012 versions of the Code, not does this term appear anywhere in the text of these documents. What is that about? Did ANZ not think that someone would eventually call it on this quite blatant fabrication? Or would ANZ have us believe that this was just a(nother) mistake, a miscommunication? In a formal letter..? A pop culture beer billboard springs to mind…

At the end of September, I met with ANZ in Wellington at its invitation. The stated purpose of this meeting was for ANZ to discuss the reasons for the mortgagee sale and to address any questions I may have. I was excited to finally have an opportunity to discuss these issues with ANZ. Frustratingly, ANZ was unwilling to discuss any of the reasons for the mortgagee sales beyond repeatedly assuring me that ANZ was comfortable that it had done it could and was comfortable with its position. If that is the case then I would respectfully suggest that there is something seriously wrong with ANZ’s moral compass. I travelled four hours each way, anticipating a frank and open discussion and instead only found staff who were unprepared and unable to discuss the reasons for the forced sale of my home.

And this is what is so frustrating…that ANZ remains unable or unwillingly to justify its position. If ANZ has a serious contrary argument – beyond “we don’t agree” – then I want to hear it. I don’t want ANZ or anyone else to agree with me unless I’m right – and that’s also the question that I have asked friends, professional colleagues, lawyers etc and no one can show me that reverse smoking gun that undermines the position that I have put to ANZ for five years, come next Friday.

If ANZ had been as willing to resolve this in 2013 as it became in 2016; if it had reduced my liability under the guarantee in 2013 as it did in 2016, both our positions would be considerably more favourable. Instead, ANZ embarked on this bizarre course of obstruction (to put it politely) in the apparent belief that it wouldn’t or couldn’t get caught out. It could have done the right thing then and now I would probably be defending it, as a bank that did the right thing, over the contents of the FMA/RBNZ report.

The predicament that ANZ finds itself in now in one solely of its own making. I sympathise…to a point. I think it’s entirely likely that this situation was caused by staff from a bank (NBNZ) that no longer exists now, for whom management oversight was not as good as two banking systems merged. Certainly, I’ve found my personal banking services since NBNZ was finally subsumed totally by ANZ have been a lot better – not perfect, still enough there for me to support the FMA /RBNZ findings, but better – than there were previously. But the fact remains that staff, who ultimately belonged to ANZ, behaved recklessly in their lending processes, and avoided the obligations placed on banks in the Code….

The obligation to act fairly and reasonably, in a consistent and ethical way.

The obligation to only provide credit or increase credit limits when the information available leads the bank to believe the debtor will be able to meet the terms of the credit facility.

The obligation to inform any party providing security, of the debtor’s obligations when a credit facility is approved.

I know that banks like ANZ are people…people who go home every night to loved ones and normal lives, people who are professional and proud to work for ANZ. From what I have seen of you in the last week, that probably you. It’s unfortunate that this situation was created over a decade ago by people who possibly don’t even work for a bank now; and that even those responsible for the actions above are only the smallest minority of ANZ’s overall staff. Harry Truman said “The buck stops here” and that’s a philosophy that resounds across the communities that I am honoured to be a member of, the community that has rallied around me at a time of difficulty. Leadership and responsibility flow from the top; regardless of where the fault may have occurred, leaders take it on the chin.

And that’s pretty well where we are now. In the last week we have seen the chair of the ANZ board and the CEO of ANZ Group both speak out for a better banking culture. We have seen ANZ post an annual profit disproportionate to its market share, a profit of almost $5.5 million a day (for context, I average around $100/day, maybe a little more if I pick up some guiding work in summer). We have seen the FMA and RBNZ release a joint report that finds significant weaknesses in the governance and management of conduct risks in the major banks in New Zealand and conclude that the overall standard of banks’ approaches to identifying, managing and dealing with conduct risk needs to improve markedly.

These events are not just catalysts for improving the conduct of our banks into the future; they are also a call to repair, as best they can, the damage that has been done in the past and the decisions to start that process can only come from the top, from you and your colleagues on ANZ’s executive team and board. And it’s not hard – it may feel hard but it’s not really: the anticipation is always worse than taking the plunge – you can do the right thing in not much time than it would take you to offer any comment on me or the horse I rode in on…in April 2016, ANZ said that it accepted my position. My position had been clearly stated and ANZ did not feel a need to qualify its acceptance in any way. All you need to do is just honour that statement…it might even look something like this:

Hey, team, I’ve reviewed this again and were not gaining anything by pushing this. We said we accepted Simon’s position two years ago and we didn’t conduct ourselves that well leading up to that point. All this springs from the time that ANZ was absorbing the National Bank and it’s likely that there were some cultural conflicts in the at process. Let’s just get it sorted and not inflict any more of this on Simon, his family and ourselves. We’ve got enough on our plate now with the FMA/NBNZ report and this is now just a distraction…

Up to you…it is the right thing to do…

The email version didn’t of course have any pix…but who wants to look at a wall of text where avoidable…?

Just to keep the record complete, here’s the original email I sent to Antonia via LinkedIn: